A New Kind of Wine Analytics

By Joseph L. Breeden,

Auctionforecast.com is an excellent source for wine auction histories and portfolio tracking, but our true uniqueness is in our analytics. The same database and analytics that provide robust, long-range, scenario-based forecasts also provides us the ability to explore interesting questions of the wine market. With this blog we will explore a wide range of topics that will be useful to connoisseurs and investors alike.

The analytics powering our website are different from any that have been applied to wine before. In fact, we leveraging the same kind of analysis that was successful in predicting the US Mortgage Crisis of 2009 [1] to predict movements in wine auction prices.

Several commentators rate the wines for quality or predict the quality of new vintages based upon growing conditions. Some provide price tracking of a fixed basket of wines. As investors, we wanted to know, for example, when is the best time to buy a new vintage? When does the value of a wine appreciate most rapidly? What factors drive the price appreciation of a wine and how soon can we predict this? (Note that a wine’s quality to a taster is not the same as its price appreciation.)

To answer questions like these, we start with data. We know that a specific bottle at auction will have a unique provenance, ullage, label condition, etc. Many of these factors are unavailable with the auction results, so the analysis is modeling the average condition for a bottle of a given age. Although an investor will want to make adjustments for all these unique factors, studying a bottle “on average” provides many useful insights.

A Case Study: Penfolds Bin 389

To explain our analytics, we will use Penfolds Bin 389 Cabernet Shiraz as an example. This is the most traded Australian wine in our database, with over 10,000 auction results. With an average sales price of just over $50 per bottle, this is not a wine we would typically pursue for investment, but all the dynamics of wine investing are present.

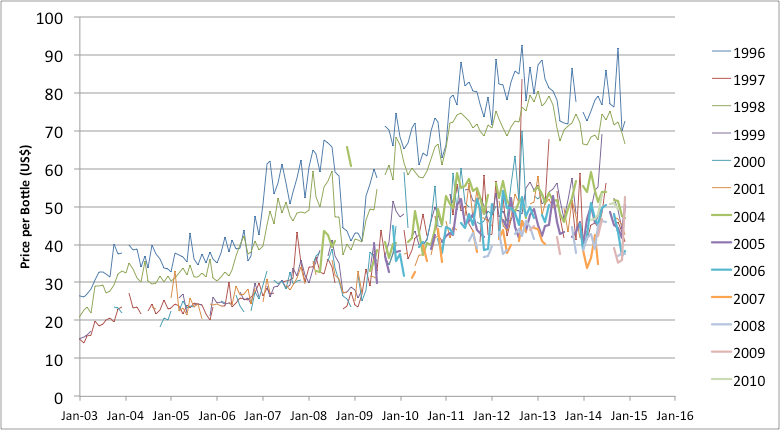

The following graph shows price histories for a range of vintages of Penfolds Bin 389. A simple visual inspection shows some of the dynamics that we expect to find in wine prices. The price per bottle for a specific vintage tends to increase with time. Some vintages command higher prices than others. The market for all vintages goes through fluctuations. The purpose of analytics is to separate and quantify these effects, in the process revealing structure that may not be apparent by eye.

Price Lifecycle

The most important aspect to understand with wine prices is the lifecycle. As a wine ages, we see an overall increase in its value. This can be due in part to increased scarcity as much of the vintage is enjoyed. It can also be due to increased interest from collectors.

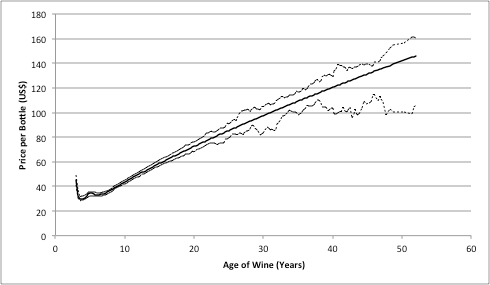

For Penfolds Bin 389, we analyzed all vintages since 1960 to produce the graph below. The solid line is the expected price versus age of the wine for an average vintage. The dashed lines are the uncertainty interval, which increases with age where we have less data.

The first 10 years of this graph is particularly interesting, since it shows that the auction price for the wine can initially decrease. Not until around the 8th year since production does the wine begin to systematically increase in value.

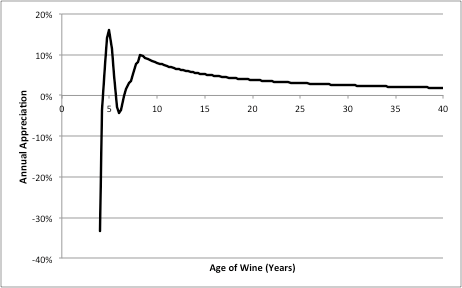

The following graph is the annual change in the price, just obtained by comparing points on the lifecycle. The initial volatility is clear. This sag in prices through the first six years or so is a common feature across most wines in our database. In short, don’t rush to buy a new vintage.

Even more important for the investor is the appreciation rate for higher ages. One auction house manager said to us, “Why do I need analytics? Just buy a wine and hold it.” True, averaged across all market conditions, wine values go up with age, but not by the same rate. For the Penfolds Bin 389, the greatest period of appreciation is between 8 and 20 years of age. Beyond that, long-term stock market returns are higher. As with any investment, when you buy and sell are key. Know the sweet spots.

Vintage Scaling

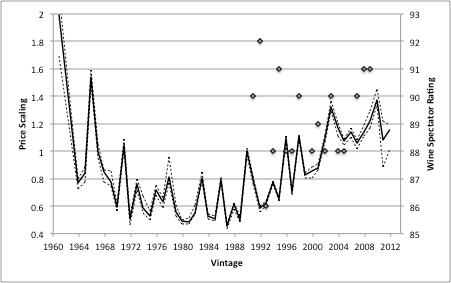

The lifecycle function shows the expected price of an “average” wine versus its age, but not all vintages are the same. The following graph captures the vintage scaling function estimated from the auction data. It shows the multiplier needed to match the performance of a given vintage to the average lifecycle. Of course, the vintages have different amounts of history to model, but the vintage scaling uses all available history.

Vintage scaling is not the same as wine ratings. As a point of comparison, we also show the ratings from Wine Spectator. You can see some correlation between the ratings peaks and the vintage scaling peaks, but price is more than just the ratings. More importantly, ratings are not available for all vintages, so we need a consistent way of modeling all wines regardless of age or popularity.

The greatest challenge is predicting the price scaling for new vintages while they are still young and before they have seen their greatest price increases. This is where are analytics are particularly robust.

Market Conditions

The third component of wine prices is the market. A good vintage at it’s greatest price appreciation point may still slump in price if the market sags, and yet measuring the market is a thorny issue.

Several groups have tried to follow the stock market index approach, where they make a basket of representative wines and track the average price of that basket. The problem is that, as we see in the lifecycle graph, the age of the wine is critical to its rate of appreciation. Any fixed basket will be biased towards increase and therefore will not reflect the true condition of the market.

Our analytical framework provides a natural solution. Prior to creating a market index, the prices are normalized for expected appreciation and the vintage scaling. This allows us to use all wines in a given category regardless of age or length of history without biasing the result. It also allows us to continually add new vintages to the market index without altering the scale.

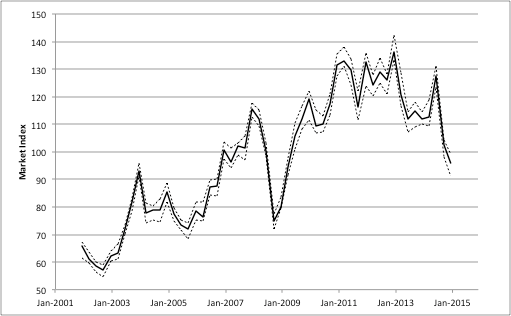

The graph below is such an index for Penfolds Bin 389. Using all auction prices for any vintage traded on a given date, we measure the oscillations in the market. From this graph, several features become apparent. The price drop in late 2008 was apparent in the vintage time series above, but here we see it cleaned of all lifecycle and vintage effects. We do not have an explanation at this time, but clearly auction prices took a hit for a period of time.

The 2008 drop appears in many of the wines in our database, as does the peak in 2012. Since 2012, we have seen across-the-board drops in auction prices for wine. In the case of Pendfolds Bin 389, we have a roughly 30% drop in the auction value for all vintages over a two-year period. By any definition, that qualifies as a bear market.

Bringing It All Together

Our price forecasts combine what we know about the price lifecycle, vintage scaling, and scenarios for the future of the market. We cannot predict these wine market indices any better than a stock market index, but in future posts we will explore correlations between the wine market and other investments. We will also provide case studies of other interesting topics.

Up next, the Lafite Bubble.

|

Joseph L Breeden, PhD has been building forecasting models for over 20 years for such areas as currency futures, sporting events, agricultural commodities, and loans. The methods he pioneered in his book, Reinventing Retail Lending Analytics (2014) are considered are considered best practice in the industry and performed well through the US mortgage crisis and many other international economic crises over the last 20 years. His love of wine and data analysis led to his participation in auctionforecast.com. Email: breeden@auctionforecast.com |

References

[1] Reinventing Retail Lending Analytics -- 2nd Impression, by Joseph L. Breeden, Risk books, 2014.